Bornea Digital Assets was born to provide regulated services on Digital Assets in the new Digital Economy

The new regulatory framework

On 24 September 2020, the European Commission published the Digital Finance Package with the aim of adapting European legislation to the new digital era with a dual purpose: to promote a dominant position of Europe in the new global digital ecosystem and to ensure the protection of investors and consumers in the face of the emergence of new payment and investment instruments. It is made up of two strategy papers and two proposals for European regulations:

- Digital Finance Strategy

- Retail Payments Strategy

- Proposal for a Regulation on Crypto-Asset Markets(MiCA)

- Proposal for a Regulation on Digital Operational Resilience (DORA).

Additionally, the Digital Identity Package has been published incorporating a proposal for a regulation on European Digital Identity.

The first recital in the MiCA states that: “The Commission’s communication on a Digital Finance Strategy aims to ensure that the Union’s financial services legislation is fit for the digital age, and contributes to a future-ready economy that works for the people, including by enabling the use of innovative technologies. (…)”

The current economy

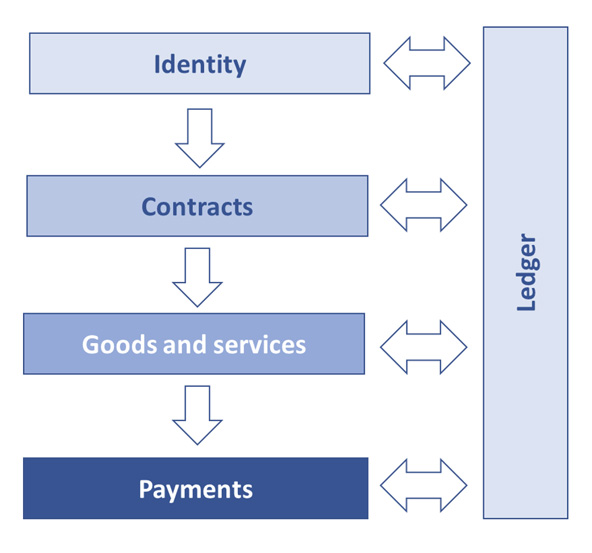

To understand how the implementation of these regulations will affect, defining the economy as a system of production, distribution, trade and consumption of goods and services of a society or a country we can consider that five elements are necessary for its development and value creation:

- Goods and services

- Business rules of transactions or contracts

- Identity of the participants

- Means of payment for goods and services transacted

- Registration of goods and services and/or their transactions

Under this model, the production and exchange of goods and services requires business rules that are materialized in contracts between the parties involved in the process that finally trigger a series of payments at some point in the transaction. To guarantee the traceability of the entire value chain, each of these elements can be registered providing the entire process with adequate legal certainty.

The decentralized economy

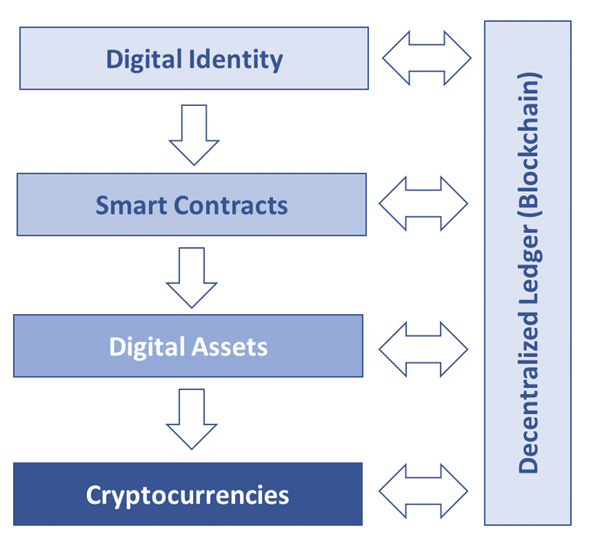

The term “decentralized” is often confused with “deregulated“. Nothing could be further from the truth. MiCA defines a Crypto -asset as a digital representation of value or rights that can be transferred and stored electronically, through decentralized registration technology or a similar technology” that we will generally refer to as Digital Assets so as not to limit it exclusively to crypto-assets regulated by the standard or supported by a certain technology.

Additionally, also included in the first recital of MiCA,”(…)The Union has a stated and confirmed policy interest in developing and promoting the uptake of transformative technologies in the financial sector, including blockchain and distributed ledger technology (DLT).”

Therefore, if we move the elements of an economy according to the definitions contained in the proposal for a regulation for a decentralised economy, we would have the following equivalences:

| Goods and services | Digital Assets |

| Contracts | Smart Contracts |

| Identity | Digital Identity |

| Means of payment | Cryptocurrencies |

| Registration | Decentralized Ledger Blockchain |

For such a decentralized economy to be implemented and scaled, it will be necessary for each of these elements to be implemented safely and reliably.

Catalysts

In a digital economy, the identification of the parties takes on a special relevance and precisely the European Digital Identity Proposal lays the foundations for this interoperability framework.

Likewise, from the point of view of digital assets, the MiCA proposal was born with the aim of establishing a harmonized regulatory framework at European level that, in addition to regulating the issuance of certain crypto-assets, such as e-money tokens, asset-referenced tokens or utility tokens, will regulate the different services that can be provided on these or any other crypto-asset,such as:

- Custody and administration of crypto-assets on behalf of third parties

- Execution, receipt and transmission of orders on behalf of third parties

- Advice on crypto assets

- Portfolio management of crypto-assets

- Placing of crypto-assets

- The operation of a Trading Platform for crypto-assets

Moving to the payments layer, although some of these crypto assets, especially electronic money tokens or asset-reference tokens, may be used as a generally accepted mean of payment, it is advisable not to lose sight of other initiatives that will expand the payment alternatives of end users. In this sense, the ECB communicated in July 2020 the continuity of its CBDC project (Central Bank Digital Currency), which in turn has the support of the European Commission through its Retail Payments Strategy document, and which will require the financial system for its distribution, leaving its issuance in the hands of the ECB.

Additionally, this strategy document promotes the use of instant payments at a pan-European level, as well as open, fair and transparent access for all market players to payment infrastructures. This will promote the development of services by payment institutions and electronic money, which until now have not been available or needed the use of credit institutions.

Last but not least, all this development will be carried out under the new Digital Operational Resilience regulations who have as their main objective to improve the management of risks related to information and communication technologies (ICT). To this end, it will establish uniform requirements regarding the security of the networks and information systems that support the business processes of financial institutions in general.

Therefore, these are the points where the greatest movements and advances will take place in the next three years marking the development of the European digital financial ecosystem and constituting the fundations of Bornea Digital Assets’ strategy:

- Legal framework for crypto-assets

- Emission

- Services

- Euro Digital: Central Bank Digital Currency

- Open payments infrastructure

- Instant payments

- Digital Operational Resilience

Scale decentralization.

The current financial system is fiduciary and based ontrust. Trust is based on the existence of a regulatory framework that protects the interests of the various stakeholders. Without this regulatory framework, the necessary legal security enviroment cannot be built.

That is why other less regulated environments have suffered more virulently than the financial system the emergence of new operators and business models that have scaled exponentially. This is despite having similar characteristics.

According to the 6D’s model of the theory of Exponential Organizations, when a business model is Digitized, Dematerialized, Demonetized and Democratized, there is a process of acceleration of new business models that go from a state of Disappointment with reduced growth to a situation of Disruption creating new markets.

When we try to apply this process to the financial system, despite being a highly digitized environment that would meet the first 4D’s, this process of aggressive disruption has not yet occurred. The reason for this can be found in that it is not a deregulated environment but is highly regulated and requires the intervention of the regulator to facilitate the processes of disruption. The end users themselves, when using these services to manage their investments, savings or financial transactions, demand a safe and reliable environment.

The new regulatory package will introduce the necessary elements so that new financial services can be developed with all the guarantees for all those involved in themarket. These new services will have to be developed or adapted to the new regulations, which will be demanding in their implementation to maintain the confidence of the system.

In this environment, Bornea Digital Assets was born, with the purpose of contributing to scale the decentralization of the economy, being designed from the beginning anticipating the requirements that will be established by the new regulations and providing a regulated, safe and reliable environment that guarantees the protection of companies and end customers in their transactions with crypto assets and the future digital euro.

Bornea Digital Assets will initially be built as an open platform that will allow the reception, transmission and execution of orders on behalf of third parties, facilitate the custody and administration of Digital Assets and also provide the necessary infrastructure to perform a currency exchange service associated with payment services, including the necessary infrastructure to be able to safeguard and use the future digital euro.